It’s always in a company’s best interests to keep its dividend payout ratio stable or improve it, even during a poor performance year. You can calculate the dividend payout ratio in several ways for a company, though due to the inputs used, the results may vary slightly. The dividend payout ratio is an excellent way to evaluate dividend sustainability, long-term trends, and see how similar companies compare.

How Do You Calculate the Dividend Payout Ratio?

- That means the company pays out 133% of its earnings via dividends, which is unsustainable over the long term and may lead to a dividend cut.

- The purpose of paying out dividends is to incentivize investors to hold shares of a company’s stock.

- The retained earnings ratio, which is the inverse of the dividend payout ratio, illustrates the proportion of earnings that a company retains for reinvestment in the business or future dividend payments.

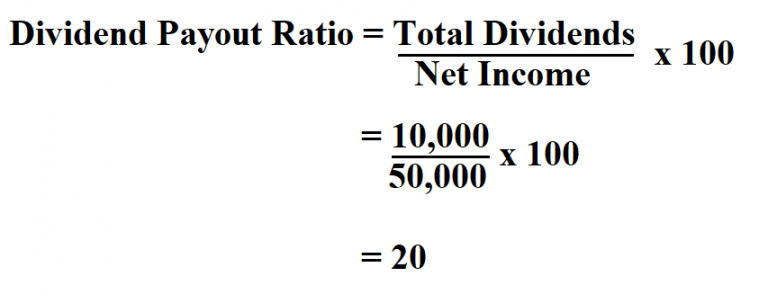

- Here, we can reasonably assume that the business will continue distributing 20% of its profit to the shareholders going forward.

- It is a short-term metric and does not capture the long-term value creation potential of retained earnings.

They often share more profits with their shareholders, leading to higher dividend payouts. Furthermore, we want to invest in companies with a compound annual growth rate of dividends higher than 5%. To perform such a calculation, check the CAGR calculator and input the dividend the company paid 5 years ago and their last yearly dividend. Several investor gurus recommend a dividend payout ratio under 60%, stating that if a company surpasses such a payout ratio, it may face future problems in holding the level of dividends.

Earn More With Dividend Stocks Than With Annuities for Your Retirement

The company paid 31.25% of its profit to shareholders in the form of dividends and retained 68.75% profit in the business for growth. The dividend payout ratio can vary year over year due to changes in the company’s earnings, dividend policy adjustments, or shifts in the company’s investment strategies. The dividend signaling theory suggests that changes in the dividend payout ratio convey important information to investors about a company’s future prospects. An increase in the ratio may signal positive expectations, while a decrease may indicate financial difficulties. Cutting the dividend also puts a blemish on the company’s dividend track record, which means that dividend investors will be reluctant to invest in the company in the future. This is often why companies allow their payout ratio to rise; they are reluctant to cut the dividend until they stubbornly do it at last possible moment, possibly causing more damage than good if they did it earlier.

Dividend Stability

As the inverse of the retention ratio (and the sum of the two ratios should always equal 100%), the payout ratio represents how much capital is returned to shareholders. The higher the payout ratio, the more its sustainability is generally in question, especially if it’s over 100%. A low payout ratio can signal that a company is reinvesting the bulk of its earnings into expanding operations.

Nevertheless, watch out for a dividend payout ratio that has plateaued, particularly if the company previously used to increased dividends every year. Even if the ratio is at a healthy level, the failure to continue to increase dividends over time could be a warning sign. Companies can sometimes endure a certain period of declining profits without suspending dividends, and it is often in their interest to do so in order to keep the shareholders and stock markets happy. Essentially, there is no reason for mature companies to accumulate excessive cash reserves if they cannot use the money to pursue growth opportunities–so they rather spend their surplus income on shareholder dividends. On the other side of the spectrum, a DPR over 100% means a company is paying out more in dividends than the cash it is taking in.

This approach aligns with the strategic priority of securing future growth and market dominance. The dividend payout ratio, often just called the payout ratio, tells us how much of a company’s profits are given out as dividends to shareholders. Dividend payouts vary widely by industry, and like most ratios, they are most useful to compare within a given industry. For example, real estate investment trusts (REITs) are legally obligated to distribute at least 90% of earnings to shareholders as they enjoy special tax exemptions. Since higher dividends are often a sign that a company has moved past its initial growth stage, a higher payout ratio means share prices are unlikely to appreciate rapidly. A 50% payout ratio suggests that a company is giving half of its earnings to shareholders as dividends, which might be viewed positively as it suggests a balance between reinvesting in the company and rewarding shareholders.

However, in general, this ratio is very useful when analyzing how much of a company’s profit is distributed to shareholders, assessing trends, and making comparisons. The dividend payout ratio shows what portion of available profits is distributed away to equity shareholders in the form of dividends. For an accurate calculation, it is important to use the correct figures for dividends paid and net income, which can be found in a company’s financial statements.

It’s like planting a seed and waiting for it to grow into a solid and fruitful tree. Experienced investors often use it to get a clear picture of a company’s financial health and how it rewards its shareholders. In simple terms, this ratio can give you a sneak peek into a company’s financial decisions and what they mean for you as an investor. A growth investor interested in a company’s expansion prospects is more likely to look at the retention ratio, while an income investor more focused on analyzing dividends tends to use the dividend payout ratio. The figures for net income, EPS, and diluted EPS are all found at the bottom of a company’s income statement. For the amount of dividends paid, look at the company’s dividend announcement or its balance sheet, which shows outstanding shares and retained earnings.

However, a consistently high payout ratio might also suggest that the company is not retaining sufficient earnings to support future growth or pay off debt. A company might slash its dividends, not because it’s in trouble but because it’s gearing up for a significant expansion or acquisition. Such decisions, while potentially disappointing in the short term, might lead to long-term growth and increased share prices.

A company with a 100% or higher dividend payout ratio is paying its stakeholders all or more than it’s earning. This practice may be unsustainable in the long term since the company would run out of funds. Besides the payout ratio and dividend criteria, we look for a company as a dependent 2021 with an average return on equity (ROE) higher than 12% over the last 5 years. The ROE ratio indicates how profitable the company is relative to the equity of the stockholders. Only a profitable company will be able to sustain growing dividends for the long term.

Also, companies in cyclical industries, such as consumer discretionary goods, may pay a lower portion of their net income as dividends to maintain their ability to pay out dividends in periods when the business is slower. The ratio will generally be positive, but can be negative if a company decides to pay a dividend out of prior earnings in a year when a net loss is incurred. The Dividend Stock Screener is an advanced search tool that allows investors to screen dividend-paying stocks to match their investment objectives. Companies may experience higher earnings in a bull market and opt for a lower payout ratio to invest in growth opportunities.