If the allocated overhead exceeds the actual overhead, the difference is termed overapplied overhead. For instance, if a company estimated $100,000 in overhead costs but only incurred $90,000, and allocated $95,000 based on the predetermined rate, the overapplied overhead would be $5,000. The management of overapplied overhead has far-reaching implications for cost accounting practices within an organization.

Underapplied overhead journal entry

This misrepresentation can affect various financial ratios and metrics that stakeholders rely on to assess the company’s performance. For instance, an inflated gross profit margin might suggest higher operational efficiency than what is actually the case, potentially misleading investors and management. For example, based on estimation, we credit $10,000 into the manufacturing overhead account to assign the overhead cost to the work in process. However, the actual overhead cost which is debited to the manufacturing overhead account is only $9,500. However, during the course of the year, production is more efficient than expected, and actual overhead costs only total $950,000.

Managing Overapplied Overhead in Cost Accounting

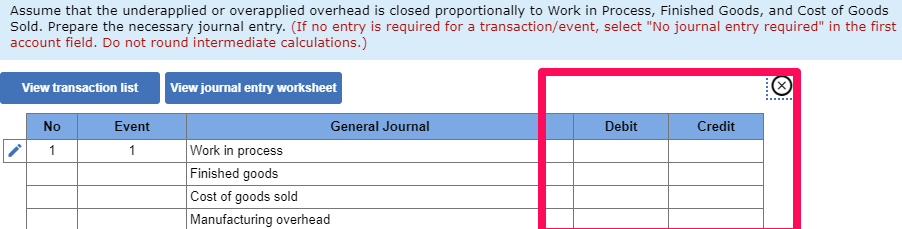

- If the amount of overapplied overhead is significant, it may be spread out across various inventory accounts and cost of goods sold in proportion to the overhead applied during the period.

- In this case, if the manufacturing overhead has a debit balance it means that that the applied overhead is less than the actual overhead.

- In cost accounting, managing overapplied overhead is a critical task that can significantly influence an organization’s financial health.

- On the other hand, the company can make the journal entry for underapplied overhead by debiting the cost of goods sold account and crediting the manufacturing overhead account.

- That figure is the company’s «applied» overhead, the amount assigned to items in inventory.

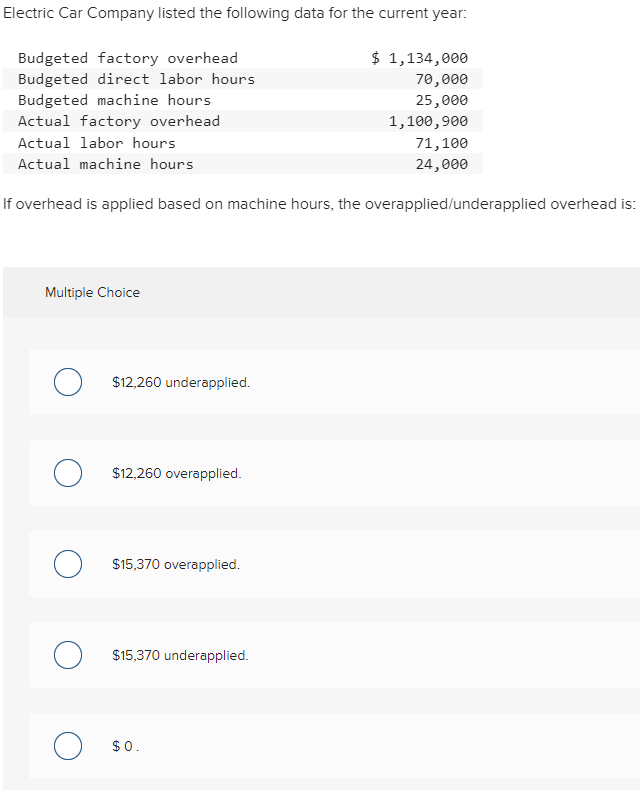

The initial predetermined overhead cost rate is calculated by taking the budgeted overhead costs divided by the budgeted activity. During the course of the year many businesses choose to budget and project future expenses. This helps management plan for cash flows throughout the year as well as establish goals.

FAR CPA Practice Questions: Calculating Interest Expense for Bonds Payable

Analyzing underapplied overhead takes on greater significance for certain businesses such as manufacturing. Often as part of standard financial planning and analysis (FP&A) activities, careful review on underapplied overhead can point to meaningful changes in operational and financial conditions. These can be useful in assessing capital budgeting decisions and the allocation of limited resources from time, money, and human capital.

Strategies for Managing Overapplied Overhead

Overhead refers to indirect costs that are not directly tied to a specific activity such as manufacturing or production. These costs are typically applied to products or services using a predetermined overhead rate. When overhead has been overapplied, the proper accounting is to debit the manufacturing overhead cost pool and credit the cost of goods sold in the amount of the overapplication. Doing so results in the actual amount of overhead incurred being charged through the cost of goods sold.

If, at the end of the term, there is a debit balance in manufacturing overhead, the overhead is considered underapplied overhead. A debit balance in manufacturing overhead shows either that not enough overhead was applied to the individual jobs or overhead was underapplied. If, at the end of the term, there is a credit balance in manufacturing overhead, more overhead was applied to jobs than was actually incurred. Likewise, it needs to debit the manufacturing overhead account as in the journal entry above. If, at the end of the term, there is a debit balance in manufacturing overhead, the overhead is considered underapplied overhead. Essentially, overapplied overhead means that a company has applied, or charged, less in overhead costs than it actually incurred.

As the manufacturing overhead costs that are applied to the production are based on the estimation, it rarely is equal to the actual overhead cost that really occurs during the period. In some cases, the overapplied overhead may also be allocated to work-in-process (WIP) inventory and finished goods inventory accounts, depending on where the overhead costs were initially applied. Adjusting entries in these accounts involve debiting should taxes on stock influence your decision to buy or sell the manufacturing overhead account and crediting the respective inventory accounts. This ensures that the inventory valuations on the balance sheet are accurate, reflecting the true cost of production. Once the period concludes, actual overhead costs and actual activity levels are recorded. The next step involves comparing the allocated overhead, calculated using the predetermined rate, to the actual overhead incurred.

This process is done by estimating a predetermined overhead rate that can be used to split costs between jobs and departments. At the end of the period, the estimated costs and the actual costs incurred are compared. As the company goes about its business making products, its accountants will charge manufacturing overhead expenses to inventory based on the number of machine hours used in production and the estimated rate. Say that over the course of the year, the company winds up running its machines for a total of 15,000 hours. That figure is the company’s «applied» overhead, the amount assigned to items in inventory.